FinChat Review

-

Ease of Use

-

Value

-

Quality

Summary

FinChat is a stock research platform that includes a variety of AI tools designed to streamline the research process. This platform includes a variety of features such as fundamental analysis, charting tools, stock screening ability, an AI copilot, and more. Learn everything you need to know about this platform by reading our complete FinChat review now.

Pros

- Extensive fundamental data including company-specific metrics

- Clean, user-friendly data visualizations

- AI Copilot can answer detailed questions about company financials

- Free plan provides access to large amount of fundamental data

Cons

- Slow performance when creating visualizations

- Stock screener relies too much on plain-text filters

FinChat is a fundamental stock research platform that uses AI tools to streamline your research process. It offers a professional-looking terminal and with some unique options for summarizing and analyzing company data.

In my FinChat review, I’ll take a closer look at all of the service’s AI-powered features and see how it stacks up against other fundamental research platforms. Keep reading to find out if FinChat is right for you.

About FinChat

FinChat is a relatively new fundamental research terminal service that launched in 2023. The platform offers a new take on stock research by incorporating generative AI chatbots, which can answer investment questions, generate data visualizations, and help you uncover opportunities.

Despite being relatively new, FinChat claims its platform is used by more than 250,000 private investors and professionals at investing institutions around the world. It has partnerships with numerous hedge funds, plus an API to allow financial institutions to integrate its AI-powered tools into their existing workflows.

Finchat Video Review

FinChat Pricing

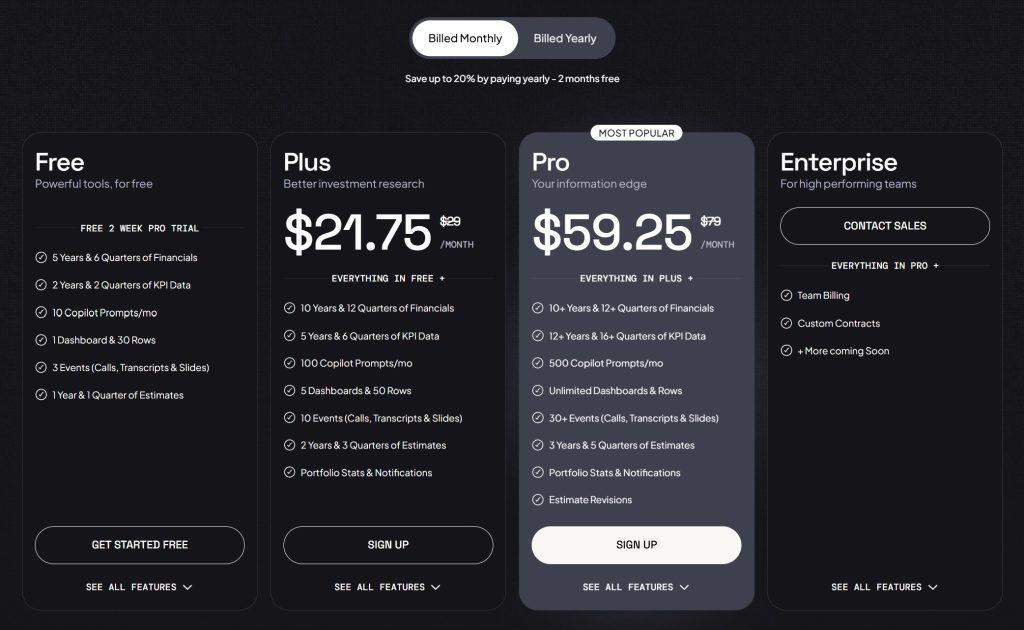

FinChat offers three plans for individual investors: Free, Plus, and Pro.

The Free plan limits you to a single dashboard and 10 Copilot (FinChat’s AI assistant) requests per month. While access to historical data is limited to the past five years, the Free plan is impressively robust and includes nearly complete access to FinChat’s data tables and visualizations.

The Plus plan costs $29 per month or $288 per year and includes five dashboards, 100 monthly Copilot requests, and much more extensive historical data, especially for company-specific metrics.

The Pro plan costs $79 per month or $768 per year. It offers unlimited dashboards and Copilot requests, premium customer support, and the ability to create custom metrics.

FinChat offers a free two-week trial of the Pro plan when you sign up. However, I think most investors will find all they need in the Free or Plus plans. The Free plan is great if you want FinChat’s financial data but don’t need the AI Copilot, while the Plus plan is best if you plan to utilize all of the AI features or want more historical data.

FinChat Features

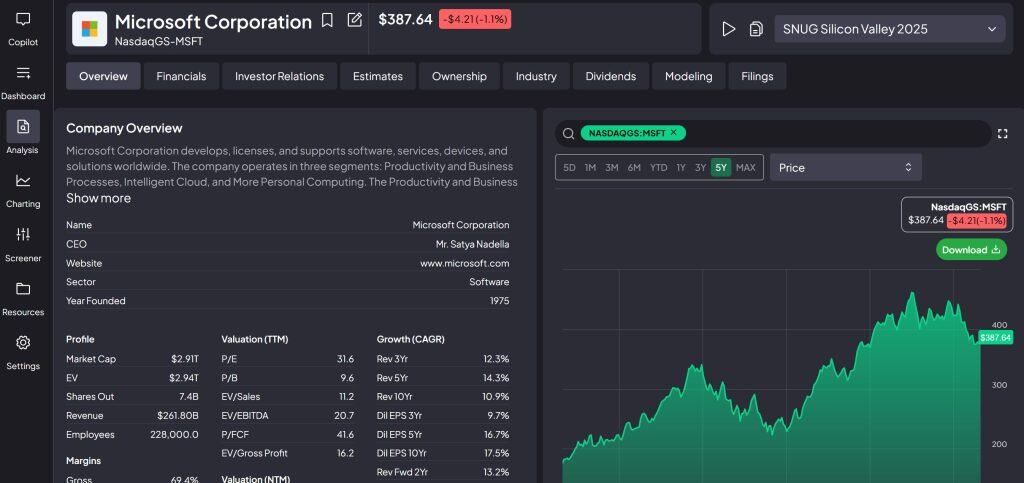

Fundamental Analysis

FinChat offers an in-depth look at financial performance and fundamentals for more than 100,000 companies around the world. For any company, you can dive into a detailed overview, key financial information, details about insiders and top stockholders, SEC filings, and even transcripts from recent investor events and earnings calls. The information is laid out nicely and it’s nice having access to filings and investor event transcripts in a single place.

The real benefit of FinChat’s financial analysis platform, though, lies in its extremely detailed look at companies’ data. You can look back at a company’s income sheet, cash flow statement, and balance sheet going back up to 20 years (with a Pro plan). FinChat also has several tables related to financial ratios, including valuation metrics, capital efficiency metrics, profit margins, and financial metrics relative to share price or number of employees.

🏆 Top Rated Services 🏆

Our team has reviewed over 300 services. These are our favorites:|

📈 Best Day Trading Service Investors Underground 🎯 Best Stock Scanner Trade Ideas 📉 Best Stock Charts TradingView |

💰 Best Stock Picking Service Motley Fool 📱 Best Mobile Broker Webull 📊 Best for Stock Research Seeking Alpha |

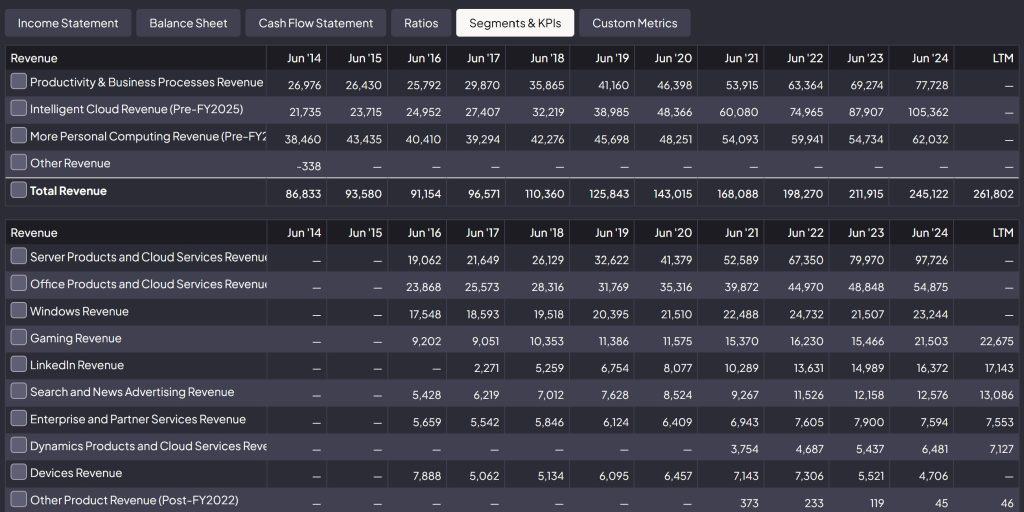

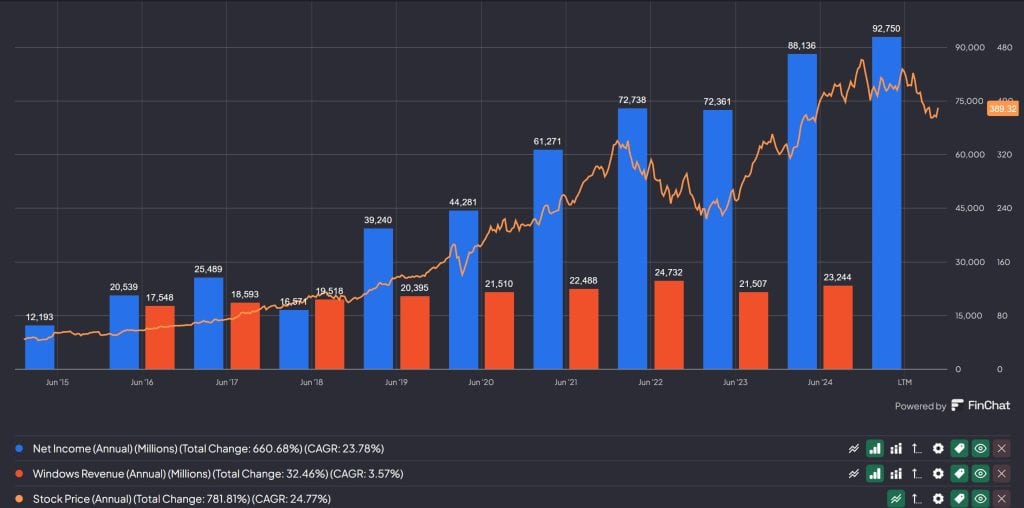

Even better, FinChat offers company-specific key performance indicators (KPIs) that provide more information about where a company’s revenue and growth are coming from. For example, for Microsoft, KPIs break down the software giant’s revenue from Windows, Office, gaming, cloud services, LinkedIn, and more. They also show growth in the number of users or revenue for key products like Office 365 and Azure, plus break down total revenue by major geographic markets like the US.

This kind of data is incredibly useful, and not particularly easy to find otherwise. Most fundamental analysis platforms that FinChat competes with, like Seeking Alpha, provide in-depth financial information, but don’t break down growth or revenue in company-specific ways like according to different business lines.

Fundamental Charting

Another thing I like about FinChat is that it makes it incredibly easy to visualize all of the fundamental data the platform offers.

When researching a single company, you can click on any of the lines within FinChat’s tables to instantly add them to a chart. By default, the charts do a pretty nice job of giving each data point a different line or bar style and color, so it’s easy to see what’s going on without spending a ton of time formatting. Depending on the dataset, you can toggle between line, bar, and stacked bar chart displays.

You can also compare any of FinChat’s fundamental metrics across multiple companies. This is a really nice way to analyze multiple companies within the same sector.

These multi-company charts can get crowded, so I really like that FinChat gives you the option to split them into multiple panels (by company or metric). All of the data is also available in table form and you can optionally convert any metric to percent change over time to better compare companies of very different sizes.

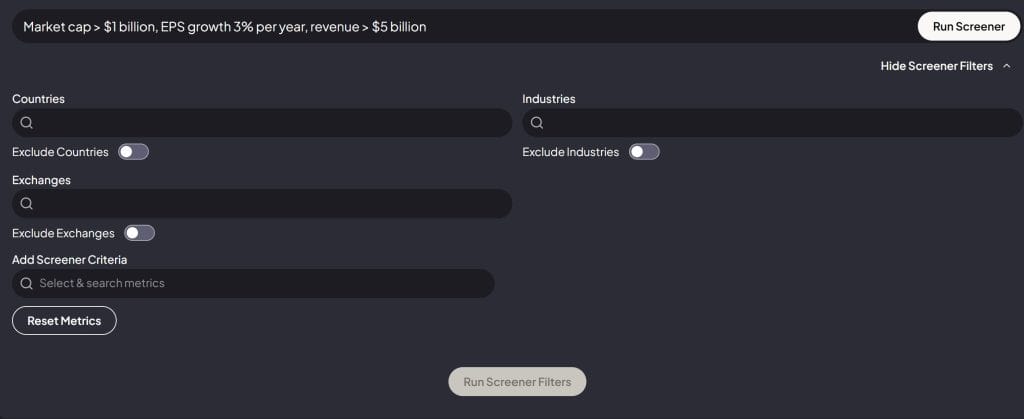

Stock Screener

I was less thrilled with FinChat’s stock screener, which is only available with a Pro plan and relies heavily on AI to parse plain-English filters. There are drop-down menus for certain filters like country, industry, and income statement metrics, but for everything else you have to type in what you want to search for.

While this is a neat idea in principle, in practice it means a lot of typing. If you want to screen stocks based on market cap, revenue, and P/E ratio, for example, you have to write out each of those filters.

On the bright side, the screen results are laid out in an easy to read and fully customizable data table. You can also save screens and export results to a watchlist.

AI Copilot

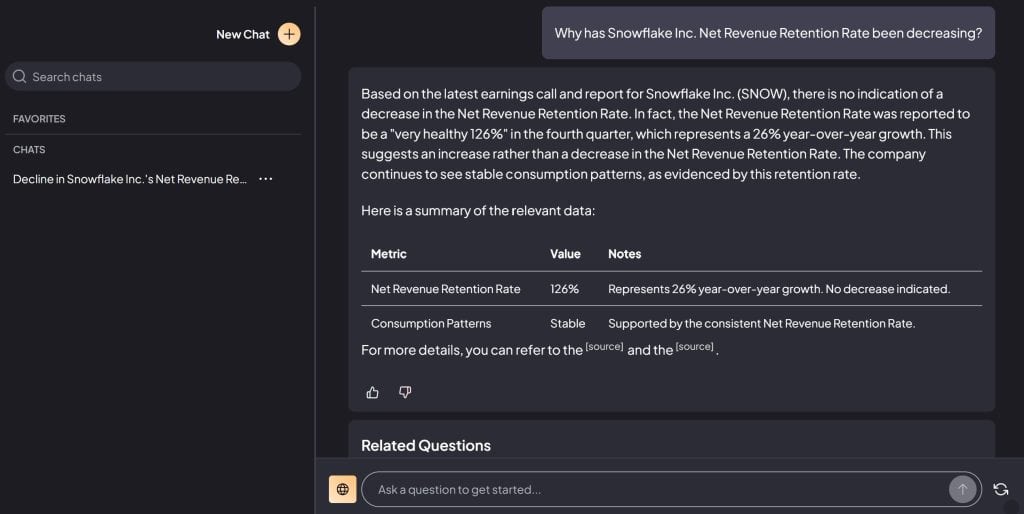

FinChat incorporates generative AI in a powerful way with its research assistant, Copilot. This is an AI chatbot that you can ask about specific companies, metrics, and trends. The AI then researches all of the stock data available in FinChat, including SEC filings and transcripts from investor events and earnings calls.

The result is pretty neat. FinChat can answer questions about, for example, why a company’s revenue growth has stalled or what is driving growth in a certain market or business line. It can also generate summaries of earnings calls or quickly build data visualizations using FinChat’s charting tools. Importantly, the AI also shows any data that’s relevant to its answers and provides source links to information contained in transcripts, so you can double-check its work.

I’ve found Copilot to be pretty useful for cutting down the time it takes to deeply research a stock. I can chart a company’s key financial metrics, then simply ask Copilot what’s going on if I see a trend I want to know more about. Copilot will then sift through the company’s filings and transcripts to find the necessary information and return an answer in seconds.

Copilot can also be used for more general investing questions, like what financial metrics to consider for a growth company. However, you could also get answers to these types of questions from ChatGPT or another free chatbot, and you won’t want to waste your Copilot requests if you have a Free or Plus plan.

Is FinChat Easy to Use?

I found FinChat to be well-organized and intuitive to use. While there’s a ton of data on this platform, it’s really nicely laid out and the data tables are highly customizable. I also like that Copilot is available through a chat bar at the top of every page, so it’s easy to jump into a conversation with the AI as soon as you have a question.

The only issue I found with FinChat’s usability is that the platform runs really slowly when adding metrics to charts. It typically freezes for a few seconds before displaying the new data and responding to new clicks. There’s likely a fair amount of computation happening in the background to create these visualizations, but it does make charting with FinChat a bit less smooth.

🏆 Top Rated Services 🏆

Our team has reviewed over 300 services. These are our favorites:|

📈 Best Day Trading Service Investors Underground 🎯 Best Stock Scanner Trade Ideas 📉 Best Stock Charts TradingView |

💰 Best Stock Picking Service Motley Fool 📱 Best Mobile Broker Webull 📊 Best for Stock Research Seeking Alpha |

FinChat Platform Differentiators

FinChat is one of the most comprehensive platforms out there for fundamental analysis. While many services offer access to companies’ financial statements and SEC filings, FinChat goes much further with its company-specific KPIs and investor event transcripts (as opposed to only earnings call transcripts).

FinChat then takes all of this data to the next level with its AI Copilot, which makes it easy to summarize and analyze vast amounts of data about individual companies. While many services are integrating generative AI to help investors make decisions, FinChat’s Copilot is one of the best uses of AI for financial analysis I’ve seen so far.

Alternatives to FinChat

There are several fundamental analysis platforms to consider as alternatives to FinChat, although none of them offer quite the same level of information for self-directed investors.

Seeking Alpha, for example, does a great job of providing details about companies’ valuations and relevant metrics, but it doesn’t offer anything like FinChat’s KPIs or transcripts from investor events. However, Seeking Alpha does provide A-F factor grades and analysis articles written by expert contributors, so it’s worth considering if you want more assistance in deciding which stocks to buy.

Another alternative to consider is FinViz, which provides a very detailed stock screener and tools for visualizing fundamental data. FinViz offers different types of charts, including bubble plots and heatmaps, so it can be a nice complement to FinChat. FinViz mainly offers financial statement data and doesn’t dive into valuation ratios or KPIs.

What Type of Trader Is FinChat Best For?

FinChat is a powerful platform for self-directed investors who want to get into the weeds of fundamental analysis. It goes above and beyond in terms of the fundamental data it provides, and the KPIs can be incredibly valuable for digging deep into a company to find out where it’s headed next. The AI-powered Copilot also makes FinChat a good choice for investors who want to use AI to help them analyze stocks and cut down the time they spend on research.

That said, FinChat stops short of helping you decide which stocks to buy. It doesn’t assign factor grades or rankings to any metrics the platform tracks, and there’s little information about what analysts think about a particular company. The Copilot can help with this, but your requests are limited unless you sign up for a pricey Pro plan. So, if you don’t have a lot of experience with fundamental analysis, it might feel like FinChat is leaving you to fend for yourself.

Is FinChat Worth It?

Overall, FinChat is a powerful platform and I highly recommend checking out the Free plan if you’re interested in fundamental analysis. You can get access to many of FinChat’s best features, including some KPIs and limited Copilot requests, completely free.

The Plus plan is also relatively affordable and well worth it if you want more historical data or greater access to Copilot. I’m more hesitant to recommend the Pro plan since it’s quite pricey and its main benefit is unlimited Copilot requests. However, if you find yourself using Copilot extensively, FinChat’s Pro plan could be worthwhile.