DeepVue Review

-

Ease of Use

-

Value

-

Quality

Summary

DeepVue is a real-time stock scanner and market dashboard. This service is designed to help day traders, swing traders, and other active investors find actionable ideas using a variety of built-in scans. Learn everything you need to know about this service by reading our complete DeepVue review now.

Pros

- 150+ built-in stock scans

- Includes CAN SLIM indicators like relative strength

- Highly customizable for day and swing trading strategies

- Advanced modular dashboards with premade layouts

- Excellent tutorial videos and educational resources

Cons

- Lacks candlestick pattern recognition tools

- Doesn’t support custom indicators

DeepVue is a real-time stock scanner and market dashboard designed to help day traders, swing traders, and active investors find actionable ideas. It’s very flexible and comes with a wide range of built-in scans to help you hit the ground running.

In my DeepVue review, I’ll explain how this platform works and how I use its scanning capabilities to find trade opportunities. Keep reading to find out if DeepVue is right for you.

About DeepVue

DeepVue is a relatively new stock scanner that launched in 2023. It aims to help traders find actionable setups with included real-time data, customizable dashboards, and ready-made scans.

One thing that’s especially noteworthy about DeepVue is that the team behind this software has been actively adding new features based on user input. That makes DeepVue a lot more dynamic than some of its established peers. The service also has a large volume of educational videos to help new users navigate the platform’s various tools.

DeepVue Video Review

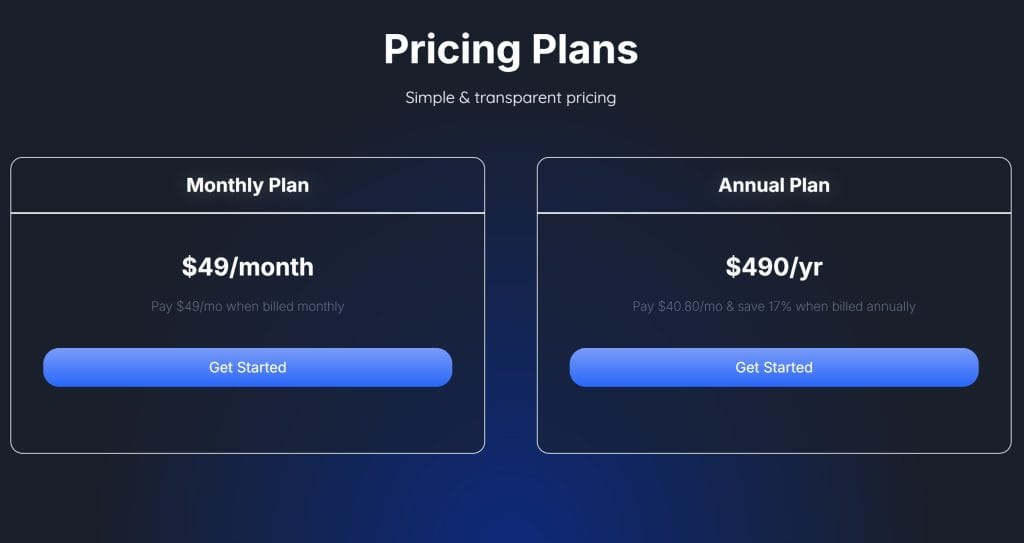

DeepVue Pricing

DeepVue costs $49 per month or $490 per year. There’s no free trial or money-back guarantee, so you have to sign up for a month in order to try out the platform yourself.

DeepVue Features

Real-time Scanner

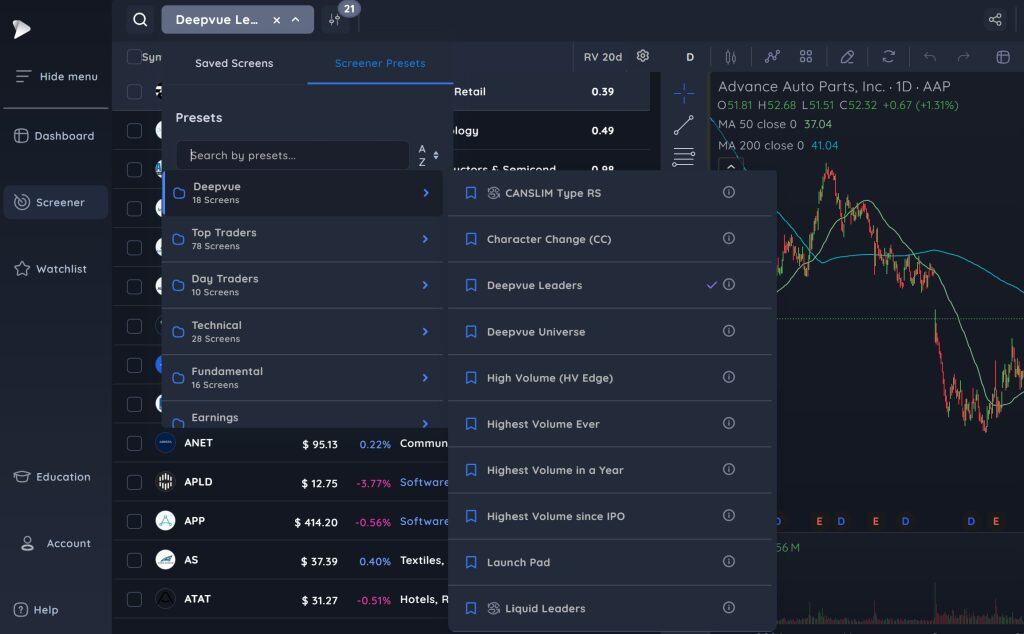

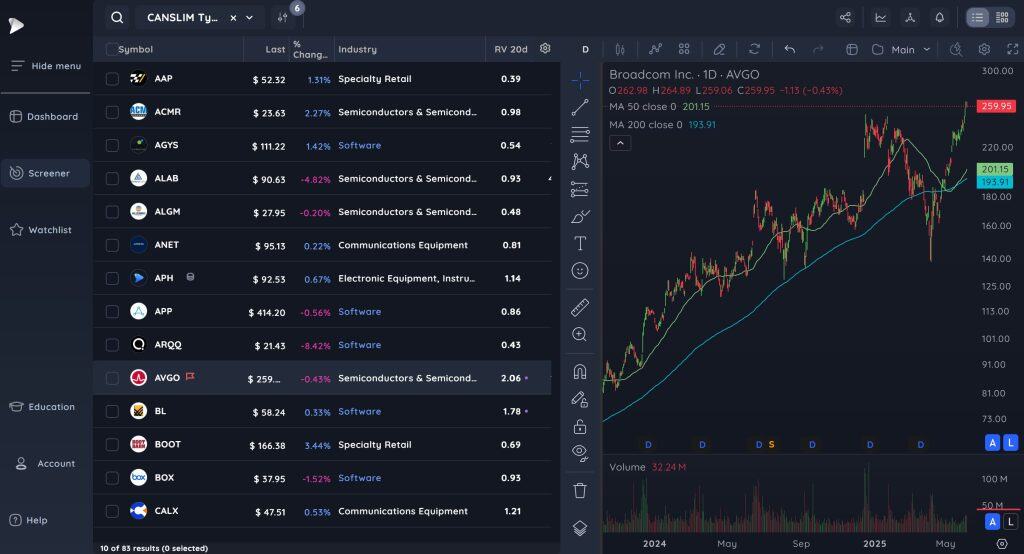

DeepVue is a real-time stock scanner that includes data about tens of thousands of US and international stocks. You can jump in with more than 150 built-in technical and fundamental screens or create your own custom screens.

The built-in scans cover a wide range of trading styles and goals. For example, day traders can use pre-built scans for price gaps or unusually high volume. Swing traders will find scans for stocks pulling back from a moving average, momentum leaders, consolidation patterns, and volatility contraction patterns. Active investors can use screens to find stocks with accelerating sales growth, increasing institutional or insider ownership, or upwards earnings estimate revisions.

Some of the most noteworthy screens in DeepVue are based on William O’Neil’s popular CAN SLIM strategy, which considers both technical and fundamental strength. There are numerous scans for stocks with high relative strength (i.e. outperformance compared to the rest of the market) or a combination of CAN SLIM indicators like earnings growth, increasing institutional ownership, and within-sector strength. The inclusion of these scans—and the ability to create custom scans that include CAN SLIM criteria—makes DeepVue a viable alternative to Investor Business Daily’s MarketSurge system, one of the most popular platforms for CAN SLIM investors.

You can bookmark any of the premade screens, duplicate and customize them, or create your own screen from scratch. I was very impressed by the flexibility of DeepVue’s screen creator, which includes more than 800 parameters. It also lets you add ‘or’ logicals to your scans, supports ranges of values in addition to greater/less than logic, and lets you customize the timeframe for most parameters. You can’t create your own indicators or insert custom code, but most traders won’t feel a need to given how adaptable this screening tool is.

The scanner results table is fully customizable as well, so you can display and sort by whatever parameters are most relevant to your strategy. You can save custom sets of columns—and DeepVue includes several preset column groups for day trading, swing trading, and fundamental investing. Relative strength, sector rank, EPS growth, and other relevant metrics for the CAN SLIM strategy are available as columns so you can reference this data when evaluating screen results.

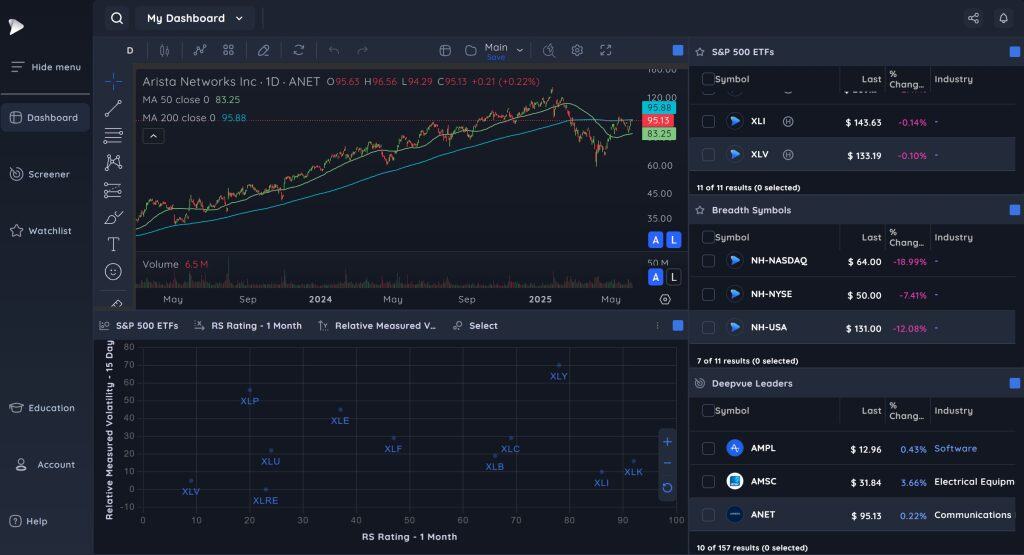

Scan results are displayed alongside a TradingView charting window, which is a nice touch. You also have the option to display your scan results as mini-charts, which is great for technical traders who want to quickly scan for setups. Just beware that the DeepVue interface can get a little crowded if you don’t have a large monitor.

🏆 Top Rated Services 🏆

Our team has reviewed over 300 services. These are our favorites:|

📈 Best Day Trading Service Investors Underground 🎯 Best Stock Scanner Trade Ideas 📉 Best Stock Charts TradingView |

💰 Best Stock Picking Service Motley Fool 📱 Best Mobile Broker Webull 📊 Best for Stock Research Seeking Alpha |

Dashboards

In addition to the scanner, DeepVue offers customizable dashboards to help you find trade ideas and monitor action in the market. I found these dashboards to be a lot more helpful than the market overview pages that a lot of trading platforms offer, in large part because you can use them to drill down into groups of stocks that are relevant to your strategy.

There are more than 15 premade dashboards available, each of which looks a bit different. Some combine charts, bubble plots, and lists of scanner results. Others include heatmaps, barcharts, and watchlists. You can also create your own dashboards by mixing and matching any of the available panel types and customizing them with different parameters.

Alerts

DeepVue also makes it easy to set up custom alerts for any stock. These can be based on price movements, moving averages, or a huge variety of other technical indicators and metrics.

The only thing missing here is the ability to set an alert for if a stock enters or leaves one of your scans. There’s a bit less flexibility in the alerts compared to the scanner, so you can’t create your own alerts to accomplish this.

Is DeepVue Easy to Use?

I found DeepVue to be very easy to use. I was able to jump right in and start building my own custom scans and dashboards. The interface can feel a little overwhelming at times, but it’s easy to remove panels from your screen or switch to a simpler dashboard layout.

The steepest learning curve is around navigating DeepVue’s premade scans. There are a lot of them, and each one has upwards of 10 filters. I liked that DeepVue explains what the goal behind each of its built-in scans is, but it still takes some practice to figure out which scans make sense for your strategy and how to use them effectively.

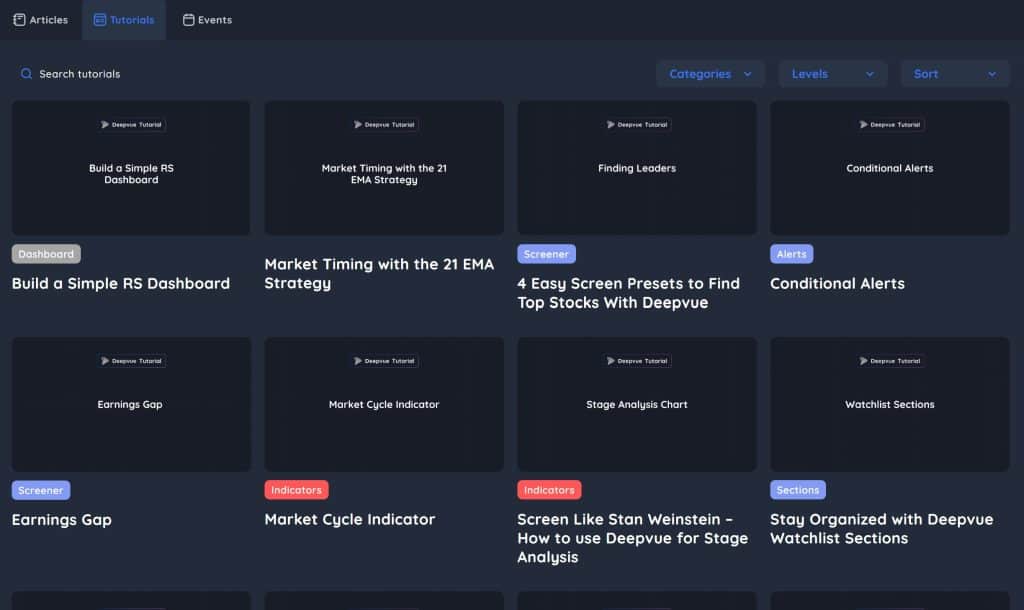

It’s also worth noting that DeepVue has outstanding educational resources to help new users. There are dozens of tutorial videos, and they’re organized into beginner, intermediate, and advanced categories. The DeepVue team even has monthly onboarding sessions if you want a more detailed tour of the platform.

DeepVue Platform Differentiators

DeepVue is set apart by its ease of use and combination of technical and fundamental data for real-time scanning. You can use DeepVue as just a technical scanner—for finding breakouts or intraday trading opportunities—but it’s at its best when you use it to find fundamentally strong stocks pushing higher.

I especially like DeepVue’s support for the CAN SLIM active investing strategy. It includes metrics like relative strength that I’ve only previously seen in products from Investors’ Business Daily, the company founded by William O’Neil.

The other thing that helps DeepVue stand out is its flexibility. Not only can you create a virtually limitless array of scans, but you can also create custom dashboards to help you monitor individual stocks or the market at large. DeepVue’s dashboards are a lot more actionable and customizable than what most trading platforms offer.

Alternatives to DeepVue

The closest competitor to DeepVue is MarketSurge (formerly MarketSmith) from Investors’ Business Daily. This is a stock analysis platform centered around the CAN SLIM strategy that surfaces top stocks to watch for this strategy.

Personally, I prefer DeepVue over MarketSurge for a few reasons. First, DeepVue includes customizable technical charts from TradingView, whereas MarketSurge offers static annotated charts. Second, DeepVue is more flexible, both in enabling you to build your own CAN SLIM-adjacent strategy and offering support for a much wider range of day and swing trading approaches. Finally, DeepVue is significantly less expensive—MarketSurge costs $149.95 per month.

That said, MarketSurge is worth considering over DeepVue if you want detailed trading guidance, including entry signals, stop loss levels, and price targets. DeepVue leaves it completely up to you to decide which stocks to buy and when.

If you’re mainly looking for a real-time technical scanner, DeepVue has a lot of competition. Alternatives include trading platforms like Thinkorswim, TradingView, FinViz, and TrendSpider. Out of these, I would most highly recommend taking a look at TradingView because of its support for custom indicators and TrendSpider because of its automated analysis and pattern recognition tools.

What Type of Trader Is DeepVue Best For?

DeepVue can work for a variety of traders, including day traders, swing traders, and active investors. I think it’s best-suited to swing traders and active investors who use the CAN SLIM strategy or another strategy that combines technical and fundamental analysis.

🏆 Top Rated Services 🏆

Our team has reviewed over 300 services. These are our favorites:|

📈 Best Day Trading Service Investors Underground 🎯 Best Stock Scanner Trade Ideas 📉 Best Stock Charts TradingView |

💰 Best Stock Picking Service Motley Fool 📱 Best Mobile Broker Webull 📊 Best for Stock Research Seeking Alpha |

While the service provides pre-built screens and dashboards, it leaves it up to you to determine which stocks offer the best opportunities and to find entries. So, experienced traders who have a good handle on technical analysis will likely benefit more from DeepVue’s scanner.

Is DeepVue Worth It?

DeepVue is an impressive real-time scanning platform at a relatively modest price. It comes packed with actionable scans that can help you quickly find trading opportunities and increase your profitability. DeepVue is especially affordable when compared to MarketSurge, which is the other primary software tool available to help traders using William O’Neil’s CAN SLIM strategy.

Overall, if you need a scanner that combines technical and fundamental filters, DeepVue is definitely worth considering.